Discover Reliable Financing Services for All Your Financial Requirements

In navigating the large landscape of financial services, locating reliable loan suppliers that accommodate your particular needs can be a difficult task. Whether you are considering individual financings, on-line loan providers, credit history unions, peer-to-peer financing platforms, or entitlement program programs, the choices appear unlimited. Nonetheless, in the middle of this sea of selections, the essential concern remains - just how do you determine the trustworthy and dependable methods from the rest? Allow's discover some vital variables to think about when seeking finance solutions that are not just trusted yet likewise customized to fulfill your unique monetary demands - Financial Assistant.

Types of Individual Car Loans

When taking into consideration individual fundings, individuals can choose from different types tailored to meet their specific monetary needs. For people looking to settle high-interest debts, a financial obligation combination loan is a feasible option. Additionally, people in demand of funds for home renovations or major purchases may opt for a home improvement lending.

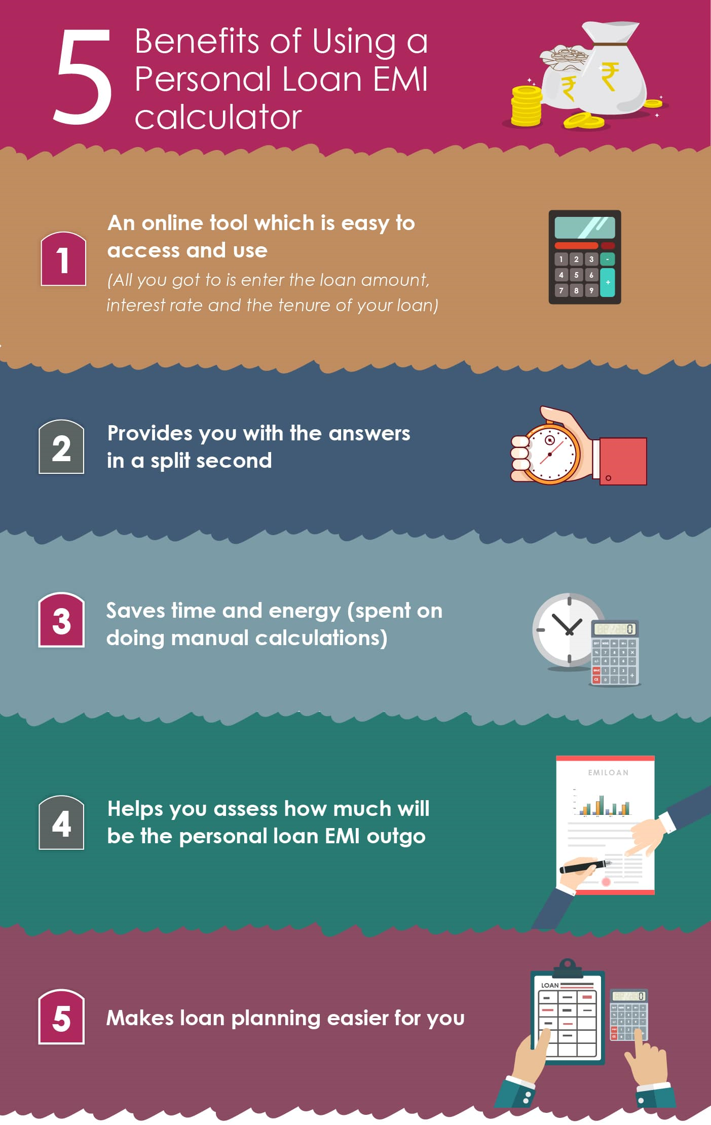

Benefits of Online Lenders

Comprehending Cooperative Credit Union Options

Discovering the varied array of cooperative credit union options can offer people with an important option when looking for monetary services. Lending institution are not-for-profit monetary cooperatives that use a range of items and services comparable to those of banks, including cost savings and checking accounts, finances, charge why not find out more card, and a lot more. One essential difference is that cooperative credit union are had and operated by their members, that are also consumers of the establishment. This ownership structure commonly translates right into reduced costs, competitive rates of interest on lendings and savings accounts, and a strong concentrate on customer support.

Credit unions can be appealing to individuals searching for a much more individualized technique to financial, as they commonly focus on participant contentment over earnings. In addition, lending institution frequently have a strong community visibility and might use monetary education resources to help participants boost their monetary literacy. By recognizing the choices readily available at credit score unions, individuals can make educated choices regarding where to leave their economic requirements.

Checking Out Peer-to-Peer Financing

One of the crucial attractions of peer-to-peer loaning is the possibility for lower passion rates compared to typical financial establishments, making it an appealing choice for consumers. Additionally, the application procedure for getting a peer-to-peer car loan is commonly streamlined and can result in faster access to funds.

Capitalists also gain from peer-to-peer lending by potentially making greater returns compared to conventional financial investment alternatives. By cutting out the middleman, investors can straight money debtors and get a portion of the interest settlements. Nonetheless, it is necessary to note that like any type of investment, peer-to-peer loaning lugs inherent risks, such as the possibility of customers back-pedaling their finances.

Entitlement Program Programs

In the middle of the progressing landscape of monetary services, an essential facet to take into consideration is the world of Government Aid Programs. These programs play a crucial function in offering financial assistance and support to people and companies throughout times of requirement. From unemployment benefits to small business loans, government aid programs intend to ease monetary burdens and advertise financial stability.

One prominent instance of an entitlement program program is the Local business Administration (SBA) financings. These financings use beneficial terms and low-interest rates to aid little businesses expand and navigate challenges - mca direct lenders. In addition, programs like the Supplemental Nourishment Assistance Program (SNAP) and Temporary Support for Needy Households (TANF) supply crucial assistance for people and families facing economic hardship

Moreover, government assistance programs extend beyond financial assistance, encompassing housing assistance, healthcare aids, and instructional gives. These campaigns intend to address systemic inequalities, advertise social well-being, and make sure that all citizens have access to standard necessities and opportunities for advancement. By leveraging entitlement program programs, people and organizations can weather monetary storms and strive towards an extra safe monetary future.

Conclusion

Comments on “Boost Your Financial Wellness with Tailored Loan Service”